King County Employee Giving Program

Thousands of ways to make a difference. Hundreds of nonprofit organizations. One Program.

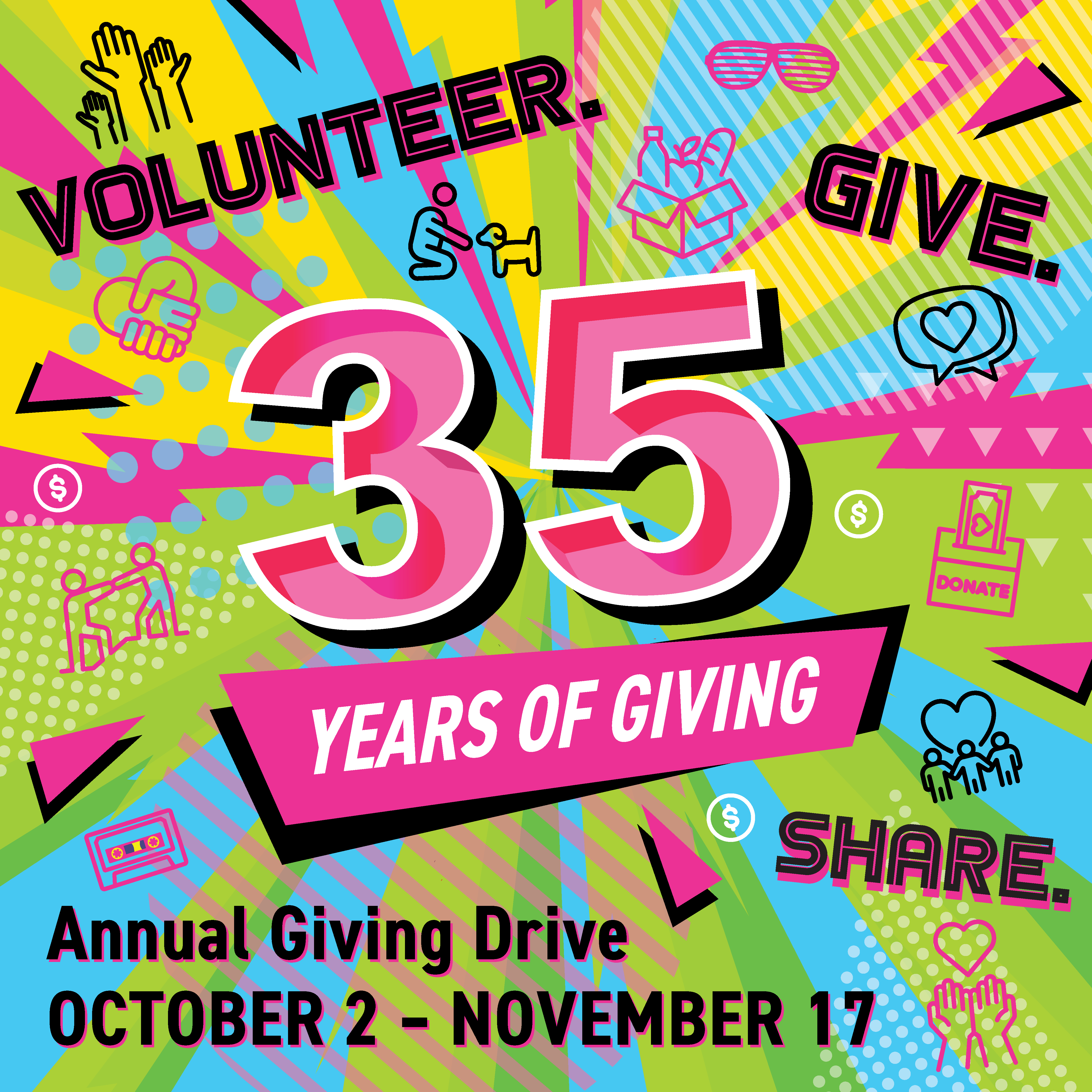

Annual Giving Drive How to Donate Find a Nonprofit Organization

Join Us!

We are making it easy for you to do the good you already want to do! From volunteering, giving after a natural disaster, or sharing about a cause important to you. We are here all year long. Join us today!

Donate (payroll and time donations) Donate (credit card)Annual Giving Drive Progress

Thank you King County Employees!

Take paid time off to volunteer

King County is offering a new program where eligible employees can use paid time off to volunteer at one of our 1100 associated charities. Take a paid day to dedicate to a cause that near to your heart, from working with rescue animals to helping out at a food bank.

Learn more

Translate

Translate