About the EGP

History

The Employee Giving Program (EGP) is the workplace giving program for employees of King County government. It was established in 1988 to create an easy and cost-effective way for employees to support their favorite nonprofit organizations, reduce the disruption to the workplace that multiple campaigns caused, and introduce an avenue for different nonprofits to participate. Essentially, EGP exists to make it easy for our employees to do good.

In 1988, there were fewer than 10 nonprofit organizations participating. Today there are more than 1,200—with more added every year! Over this time, more than $30 million has been donated by King County employees, making this the third largest public sector workplace giving program in the state.

Mission

The King County Employee Giving Program delivers an innovative and effective comprehensive giving program that empowers and engages employees, to enrich our communities and provide opportunities for all people to thrive.

Authority

The King County Employee Giving Program is established in King County Code 3.36, making us an official part of county business. Therefore, Ambassadors may use county resources in conducting their work during the Annual Giving Drive. The program allows us to raise money for nonprofits in a cost-effective and efficient way. By consolidating fundraising efforts into one program, workplace giving programs like the EGP have been shown to minimize costs to the tax-payer that multiple fundraisers in the workplace cause, at the same time achieving better fundraising outcomes and maximizing returns for the nonprofits. Win-win!

Structure of the Program

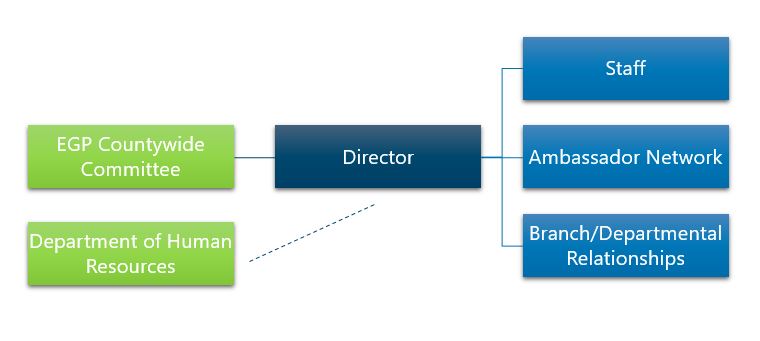

The Employee Giving Program is for all employees from all branches of King County government. The EGP is overseen and guided by a committee of up to 15 employees from all over the county and by King County Employee Giving Program staff, who report to the committee.

What the EGP does

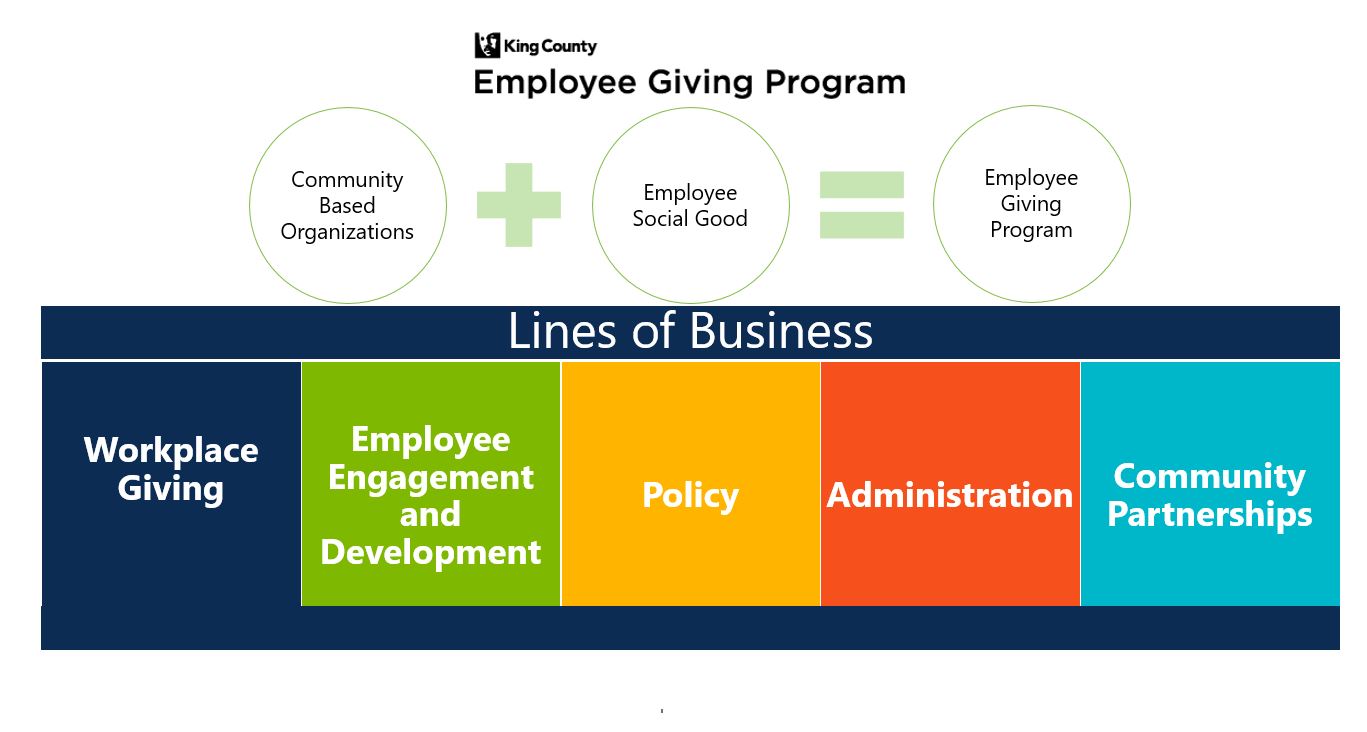

The program is hard at work all year long. We have five lines of business that meet up at the intersection of employee social good and community based organizations:

- Administration

- Community Partnerships

- Employee Engagement & Development

- Policy, Research, and Development

- Workplace Giving

This includes familiar things such as the Annual Giving Drive, natural disaster relief, and the Ambassador program. Not so known ones, such as nonprofit vetting, donation processing, and reporting, and community outreach. And new ones such as our volunteer programming.

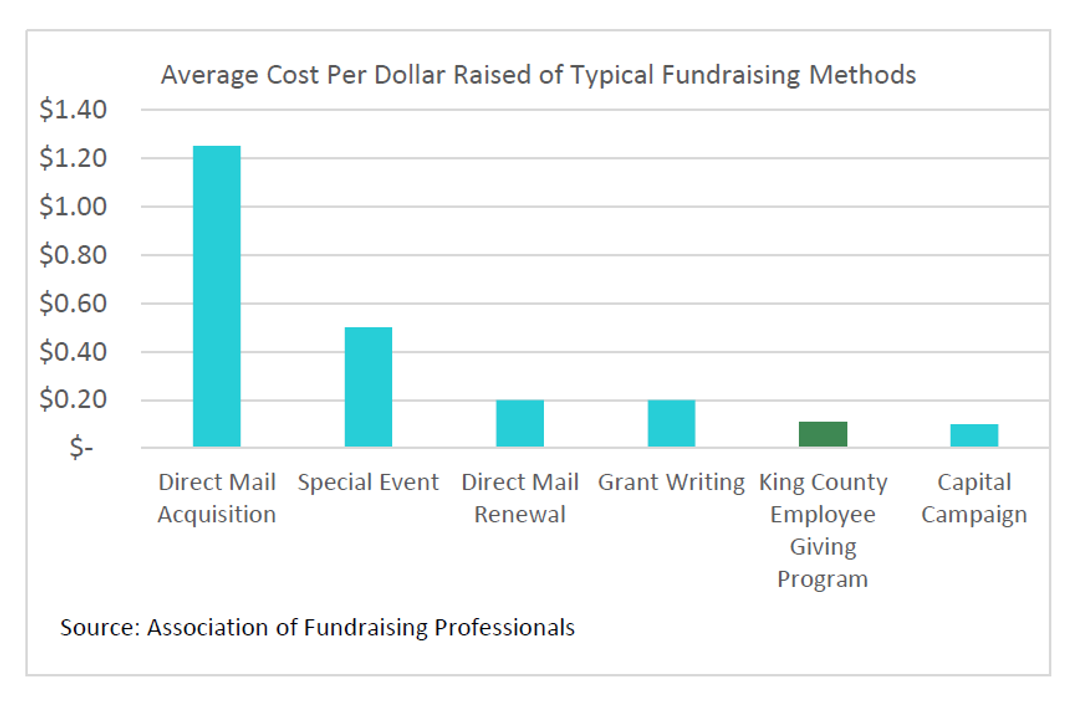

Cost of the program

The Employee Giving Program is committed to keeping the costs low and finding new efficiencies every year. Program costs are critical, because they provide the support needed to coordinate a large workplace giving program like our EGP, ensure accurate reporting and check distribution, nonprofit eligibility, and year round support. Workplace giving is one of the most cost-effective forms of fundraising.

According to the Association of Fundraising Professionals, here are some examples of national cost averages of typical fundraising methods:

- Direct Mail Acquisitions: $1.00 to $1.25 per dollar raised

- Direct Mail Renewal: $.20 per dollar raised

- Special Events: $.50 per dollar raised

- Grant Writing: $.20 per dollar raised Capital Campaign (doing a large one time capital project such as a building) $.05-$.10 per dollar raised

Additionally, EGP provides invaluable marketing to nonprofits by maximizing their exposure to a wide audience of county employees.

Nonprofits must fundraise in order to pursue their missions and they have several fundraising tools in their toolbox to do this. All of these tools must be utilized to get the most out of the nonprofits fundraising potential. Additionally, nonprofits can use the money raised through our program to leverage other grants and fundraising dollars. Workplace giving in general, and the Employee Giving Program specifically, offer nonprofits one of their most powerful, low-risk fundraising options.

Benefits of the Program

Because the EGP is an easy, cost-effective, and efficient way to raise money it allows the nonprofits to spend more time and money on the work that matters most: feeding the hungry, housing the homeless, protecting the environment, providing cultural experiences, and many others. Your participation will make a difference!

For Employees

- Easy: Fill out the online form, turn it in, done! EGP will take care of the rest. When tax season arrives, all you’ll need is a copy of your pledge form and your last pay stub of the year.

- Choice: There are over 1,100 nonprofit organizations in the program. Five ways to give (including a King County favorite—donating time). What are you passionate about?

- Privacy: Truly remain anonymous in your giving and still have all of the documentation you need for your taxes. See Section 3 of the paper pledge form or choose “remain anonymous” in PeopleSoft MyGiving.

- Investment: In yourself and your community. How many ways have you or those you care about benefited?

- Tax Deduction: EGP donations are tax deductible to the fullest extent of the law.

- Impact: In 2019, giving by individuals achieved the second-highest total dollar amount on record ($309.66 billion), according to Giving USA. You, the individual, make the difference! In 2020, King County Employees raised over $2.3 million!

- Efficient: Save time by planning ahead and not having to mail donations. Choose from prescreened nonprofits in several formats listed in one place.

- Savings: The EGP saves employees over $30,000 in stamps alone each year, money employees would have spent had they mailed their own checks. (Not to mention the envelope.)

- Emotionally: Feel happier! A compelling, and growing, body of research shows that giving as little as $5 can increase happiness. Altruistic actions literally activate the pleasure centers in the brain and have been identified as a key component of happiness and generous people tend to be healthier.

- Workplace: Employee unity, service to the community, less disruption by centralizing charitable giving, and employee engagement. Fun!

For Nonprofits

- Dependable Income: Nonprofits highly value workplace giving dollars because they are year-long, predictable and unrestricted. And when someone gives through payroll donation, research has shown that they give 3 to 6 times more!

- Lower costs: The EGP is a more cost-efficient way to reach possible donors and process donations, than other means of fundraising.

- Visibility: Inclusion in print materials and on the EGP website, targeted at more than 15,000+ employees. During the Annual Giving Drive, nonprofits may have the opportunity to come speak and introduce their work to employees. During a Nonprofit Expo they will have reached hundreds of employees personally.

- Efficient: One check contains donations from multiple donors, EGP electronic reporting, and a single point of contact.

- More bang for the buck: Each dollar received can be leveraged for other dollars; for example, undesignated funds like EGP donations can be used for matching and challenge grants from other individuals and foundations. Being a recipient of EGP dollars looks good to other grant making agencies.

- Want to know more reasons? Let the nonprofits tell you by following us on social media, checking out the website, and reading the EGP blog.

Translate

Translate